Get your taxes done by a qualified professional

By Irel Wong October 3, 2020

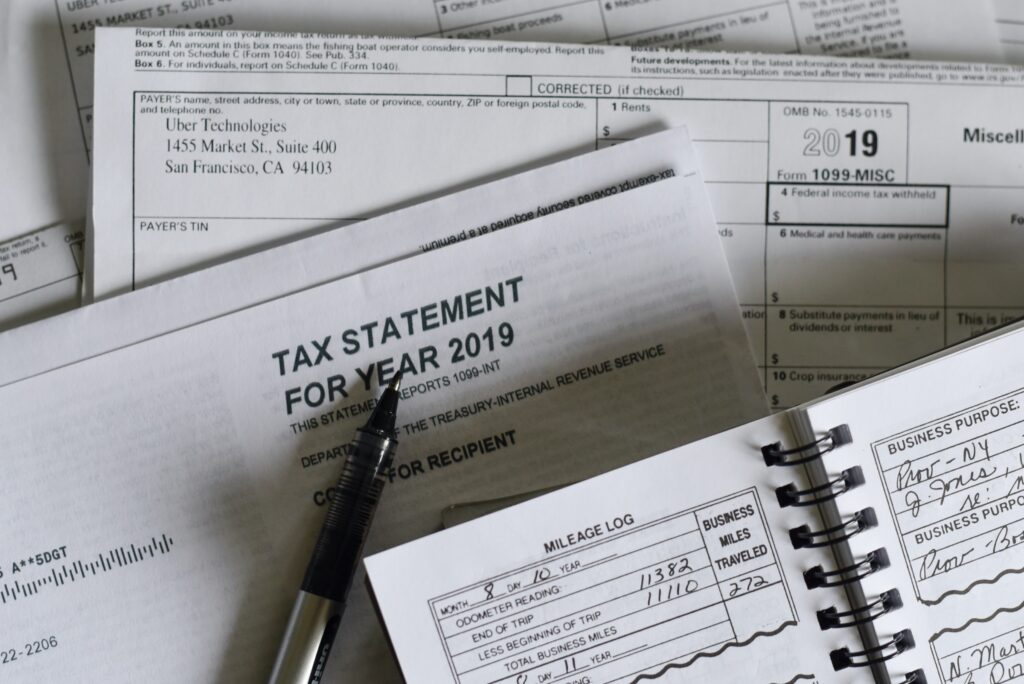

Photo by Olga DeLawrence on Unsplash

If you’ve ever visited the IRS website to brush up on tax laws, you’ll soon realize that there is so much information on each topic that you’ll easily get lost and overwhelmed. The page that has the instructions to Form 1040 is so extensive that there are over 470 links to click on just to inform yourself on that one form. Now try to imagine how many more forms, schedules and publications there are. It can drive anyone crazy if they don’t know what they’re looking for and even if they do, they would need to be prepared to spend a long time educating themself.

Why spend all that time researching, reading tax laws, getting updated on new ones, figuring out what you can deduct, how much is the limit, what is legal and what is not, when you can just pay someone whose job it is to know all that stuff? You already have a busy life, your time is more valuable to you, and you are probably going to miss something on your first few tries. If it’s one thing I’ve learned in life is to let the professionals do what they do and I focus on what I do. That way, we not only help each other but we grow in the area of our expertise.

Below I share five reasons why you should hire a professional to do your taxes.

Professionals are knowledgeable in their field of expertise

This is a given. When someone is knowledgeable about a particular field, they are already ten steps ahead in knowing how to identify problems, the best resolutions in getting it resolved and how to prevent the issue from occurring in the future. The same goes for a tax professional. I’ve been doing taxes for over 20 years and when someone comes to me to do their taxes or they received a tax bill from the IRS, my mind is already thinking about ten different scenarios that I can implement to help them lower their taxable income. This is the job of a tax expert, to be knowledgeable about tax codes so that their clients can be confident that their tax return was filed with the best possible outcome given their circumstance. While every case is different, the mission is the same – to pay the least amount of taxes you should and to receive the maximum return owed to you when you file your taxes. Someone who doesn’t have the knowledge could be missing out on hundreds or even thousands of dollars because of something they missed or a new law that they weren’t aware of. Not only could they be missing out of thousands of dollars in returns but they could also end up paying the same amount out of pocket because of their lack of knowledge. I love Finance and business related issues so I stay informed and updated on topics in this field. If someone came to me to make a piece of furniture, I would give it my best shot but I promise you that they wouldn’t like it after I’m done. Not only that I don’t have the tools or know what type of wood to use, I would make so many mistakes that it would have been so much easier just buying it from a furniture store in the first place. What I’m saying is that without being knowledgeable in a particular area, your chances of mistakes and errors are very likely and can end up being very costly.

They have the experience with preparing taxes and they know what to look for

After doing taxes for a few years, the experience you gain teaches you what to look for, what questions to ask, what is required by the IRS, what not to claim and so much more. Experience teaches wisdom and you want a tax preparer that has some experience and is keen on what to look for.

Free up your time to focus on what you need to

We all have the same 24 hours in each day and while we all use it differently, we cannot add any more time to what we have been given. The best way to use your time is towards developing yourself. Trying to learn everything, do everything, fix everything by yourself is not the best use of your time. Pay the professionals to do what they do best and use that free time to do what you do best. Time is one of the most important and valuable resources you have so think of it as paying to get back some of what is most important. When you try to save money by doing everything yourself, you are not helping yourself nor do you value your time at all. Think about all the things you want to do that time doesn’t allow you and how much it’s worth to you. By paying a tax preparer, you are essentially freeing up yourself with time to do what’s important to you.

Reduce potential errors

Have you ever tried to do something that you’re not familiar with? How did that turn out? Maybe you did a great job but there are some things that should be left to the professionals. When it comes to financial matters, you don’t want those to be on a trial and error basis. Financial errors can be costly and when it comes to the IRS, that’s not an agency you want to make a mistake with. Think about how much you will pay for a professional preparer to do your taxes and then think about your knowledge of expertise. Is that amount really worth it? You probably spend that on something that is of far less value. Don’t take the risk, don’t put yourself in a position to make a mistake, and don’t put yourself to risk a big potential loss.

Peace of mind and security

Paying for peace of mind can be one of the most valuable things you can pay for. How much is it worth to you to not worry about something after it’s done? Most likely a lot! Your peace of mind is something you can’t put a price on. With each day you already have so much going on, so much to think about and so much coming your way. The less you have to worry about, the better for you. Your taxes are the job of a professional tax preparer and their job is to take the worry from you so you can focus on more important things. You want to feel a sense of security that when your tax return is in the hands of the IRS it is done right and it’s accurate. One less thing to worry about and one less thing on your agenda of things to check up on. You can move on with your life and tackle the more weightier things in front of you.

Get your Taxes done by The Business Front Tax Specialists

Check out the Tax Services page and Contact the Business Front Tax Solutions to have your taxes done by an experienced preparer today.