The Easy Guide In Learning to Investing With Little Startup

By Irel Wong October 27, 2020

Photo by Andrea Piacquadio from Pexels

If learning to invest is like that 5000 piece puzzle you have been looking at but don’t know where to start, you are not alone. With so many investment platforms, stocks and mutual funds, and so many options and strategies, it can be intimidating even before you begin. Here you will find that learning how to invest is not as difficult as it seems. Learn how to mitigate your risk and reduce your exposure for financial loss, find out the available platforms to invest in, how to add funds into your account and how to look up stocks and mutual funds. Join the strategy of the wealthy which is to increase your knowledge about the investment world and start investing for the long term.

What is investing

For most people when they hear the word investing, they think of buying and selling stocks. Even though that’s one of the ways to invest, the truth is investing is much broader and can take many forms. If I buy a car for $400, spend another $500 to fix it up and then turn around and sell it for $2000, I just invested $900 ($400+$500) along with my time and effort to make a profit. If my sister decides to start a business and I see that she has a great idea and put $5000 into the business for a return on my money when the business becomes profitable, that’s investing. Investing then can be defined as using your money, time and efforts towards something or someone with the hopes of getting back a return on top of what you initially put in. Most people don’t want to go the route of investing in a used car or in a family business so they invest in stocks and mutual funds. The stock market, even though it can be risky, can be a lucrative avenue for investors to grow their wealth and establish themselves financially. If you’re investing for the long run, the stock market has a record of showing positive returns and with a little research and due diligence, you too can profit. As with any investments there are risks involved and the greater the risk, the greater the potential for reward or loss. While I have suffered losses, I have also been able to see profitable gains. These losses I count as lessons learned and experiences gained and I have learned a lot about taking risks. If it’s one thing I have learned is that without risks there is little or no reward and in life at some point you have to take a leap of faith. That leap however, must be guided with common sense, research, guidance, and patience. Investing takes patience and you have to view it as a marathon run rather than a sprint race. Trying to time the market will cause you headaches and huge losses and I personally don’t recommend you go that route. Many so-called investors are out there trying to lure you into the fast lane of making quick money but doing your own research is always key. Take your time as it’s best to be safe and sure rather than move too quickly and make costly mistakes.

Investment Platforms

There are many investment companies out there to choose from. For the most part they all offer an online platform where you can add funds, purchase stocks, mutual funds, ETF’s (Exchange Traded Funds) and Options. They also provide stock screening tools, technical indicators and for advanced traders there are interactive tools with real time data for analysis and research. For starters, I don’t recommend you get into the technical aspects of investing as you can get distracted from your goal which is to invest for long term growth. Below I list my top picks for investment companies to open an account with. It’s very easy to do and you don’t need any funds to open an account. Fill in the necessary fields with your information to create your account. Once completed you will need to fund the account so you can purchase stocks and mutual funds. The best thing to do is add your bank account so you can easily transfer funds. This is also good in the event you sell shares of your investment so that you can transfer funds into your bank account as well. Here are my top 5 picks for starting an investment account.

Brokerage Firm | Commission | Deposit Minimum | Research Platform | Practice Trading Platform | Can Purchase Fractional Shares |

$0 | $0 | Y | Y | N | |

$0 | $0 | Y | N | N | |

$0 | $0 | Y | Y | S&P 500 Only | |

$0 | $0 | Y | N | N | |

$0 | $0 | Y | N | Y |

How to Mitigate Risks

Everyone knows that there are risks involved when investing in the stock market. The market goes through cycles of ups and downs, companies have good and bad quarters, investors move money from one sector to another, political or civil unrest contributes to market swings, national or global crisis, and other factors all play a part in the outcome of the market. While we can’t predict or avoid many of these events that affect the market, we can mitigate or manage the risk factor by taking certain steps. In finance we categorize these risks under two headings – systematic risks and unsystematic risks.

Systematic risk refers to risk that affects a broader population, for example all companies within a particular country were affected by a recent incident. It also could be nationwide or a global impact. Most recently we saw this in action with the global pandemic from Covid-19 in early 2020 that caused the market to drop significantly. This not only affected one or two companies but the overall market. Systemic risks are for the most part hard to predict and unavoidable. They happen and there’s little or nothing you can do to stop them. Don’t rush to pull out of your investments when this happens because the market has always shown to rebound, just give it some time.

The other category is unsystematic risks. Unsystematic risk is limited to one company or a small group of companies. This is the type of investment risk where one of the companies you invested in has bad management or lacks innovation so it keeps having bad streaks of revenue losses. This affects the stock price negatively and you in turn lose money. To limit your risk in this area you have to diversify, or in other words, put your eggs in more than one basket. If you like stocks, purchase more than one stock and in different industries. Another way to minimize unsystematic risk is to invest in mutual funds. Mutual funds are portfolios of mostly stocks and bonds that have been grouped together and purchased by a pool of investors. Mutual funds are already diversified so it’s a good vehicle to use when reducing risks. Your new brokerage account has the stock screener tool to find mutual funds. Good funds to start with are index funds such as SWPPX, VFIAX and FXAIX. These are funds that index the S&P 500 and have been wonderful performers over the years. As you can see above under the Investment Platforms section, Charles Schwab and Fidelity allow you to purchase fractional shares if you don’t have all the money to pay for the funds outright. Diversify with stock purchases or use mutual funds to limit your risks.

Moving Funds to and From Your Investment Account

Accounts make it easier today to add funds and to withdraw funds. All the brokerage accounts I’ve checked out allow you to link your bank account to the investment account so that you can transfer funds into the account and move funds out of the account. The process is fairly simple and it’s all online as one of the links when you set up your account. Transfer the amount you want to use to fund your investment. Once the funds are in your account you can start purchasing.

How to Search for Stocks and Mutual Funds

Each investment platform comes with a tool called a stock screener. It is a tool that allows you to search for stocks, mutual funds or ETFs with your own predefined filters or criterias.

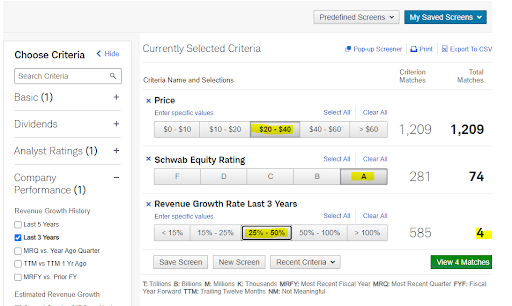

Below is a picture of a stock screener with 3 filters to screen for stocks – (1)Stocks priced between $20-$40, (2) Schwab rating of A, and (3) Revenue growth for the last 3 years between 25%-50%. Notice it shows 4 stocks meet this criteria:

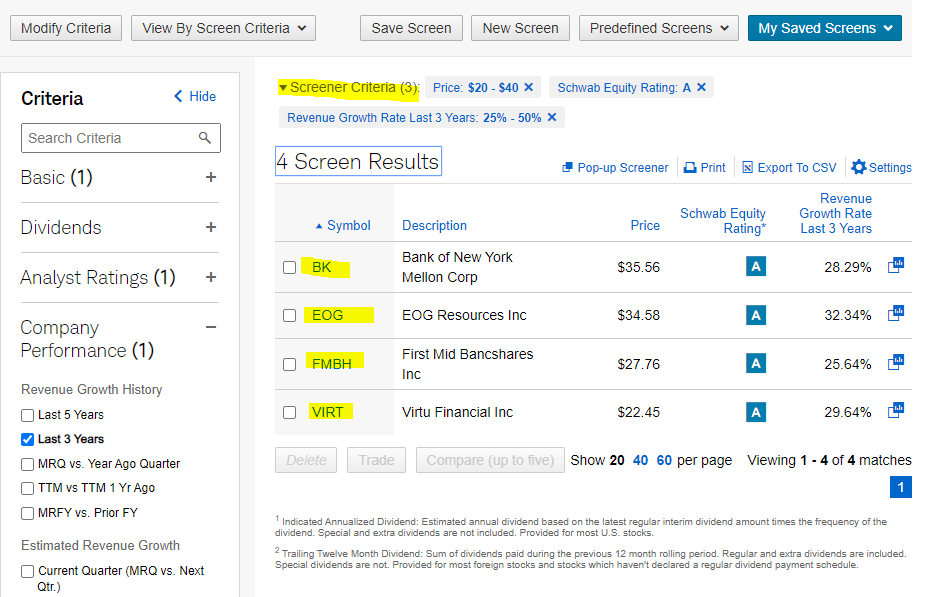

Once you click on View 4 Matches, it will reveal the 4 stocks that meet this criteria:

The stock screener is very helpful in searching for a number of stocks. I recommend you spend a little time familiarizing yourself with the filters and criterias so you can see how the tool pulls results based on your selections. Also do this for Mutual Funds and ETFs so you can see how the tool looks at different criterias for each.

Purchasing Your Stock or Mutual Fund

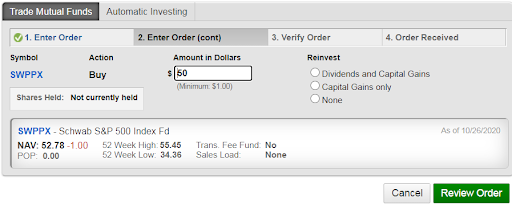

To purchase the stock or mutual fund you have identified, select the option to trade either a stock or mutual fund. Below are examples from a Schwab account:

For Stocks:

For Mutual Funds:

Review your order, follow the prompts and you will end up making your stock or mutual fund purchase. If you have done this, congratulations! It may seem intimidating at first but as you make more trades it will feel more and more natural. Try not to sell too many of your trades as this will have tax consequences and also you want to give your purchase enough time to grow.

Start Investing Today

Someone asked the question, “When is the best time to plant a tree?” The answer came back, “Ten years ago! But if you didn’t, then today.” The same goes for investing. If you had started ten years ago you would be seeing the results today but if you didn’t, then start now. Take action! Open an investment account today and start doing what you should have done a long time ago.