Know more about Mutual Funds and learn how to add them to your portfolio

By Irel Wong October 28, 2020

Image by Gerd Altmann from Pixabay

If you are in the process of learning more about the stock market and how to invest, most likely you have heard about mutual funds. A mutual fund is an investment holding consisting of stocks, bonds and or ETFs that have been pooled together to form a fund that is owned by many investors. Even though it’s owned by many people, there is a fund manager who oversees the day to day operation of researching, adding or removing stocks and bonds, and making sure the fund is increasing in value which is the overall goal. Mutual funds are a great investment vehicle for diversifying when looking to invest. The fact that they include many different securities help to minimize the risk factor and for this reason they have become a popular option for investors. Even if you are a novice in the investment field, mutual funds offer the added benefit of someone else watching over your investments giving you the peace of mind of not having to do it yourself. Many investment accounts allow you to search for mutual funds, showing you how the fund has been performing over a specified period of time. If you are looking to invest, add some mutual funds to your portfolio and allow your mind to be at ease.

Types of Mutual Funds

There are thousands of mutual funds out there but they are all grouped under one of the four classifications. Based on your investment objective, you can select the option that best fits or you can have multiple selections. The four types of mutual funds are:

1. Stock / Equity Funds – Consisting of mainly stocks otherwise known as equities.

2. Bond / Fixed Income Funds – Consisting of fixed income bonds such as government or corporate bonds.

3. Balanced / Target Date Funds – Consisting of a balanced allocation of stocks, bonds and other securities.

4. Money Market Funds – These consist of investments in government backed securities that are mostly safe but provide minimal returns.

Aside from these four, there are index funds that may fall under a mutual fund or operate as its own investment instrument. These types of mutual funds comprise the stocks that make up the companies of the index it’s following. For example, an index fund may follow the S&P 500 index and include a sample of the companies under that index. Index funds are also a popular choice as they normally have less fees since they don’t require a team of analysts to manage them.

How to find Mutual Funds

If you are the type of investor that uses an investment advisor or a subscription service, then you don’t need to worry about finding mutual funds. Your advisor or subscription service would be happy to recommend some to you based on your investment need and your level of risk tolerance. If you are the do-it-yourself type of investor, then finding mutual funds is merely using your investment account’s research platform to view available funds. Below is a screenshot of a page of the mutual fund research tool in a Charles Schwab account. There is an Overview page with a fund screener, there is a Mutual Fund Portfolios page that allows you

to build a personalized portfolio, there’s a Select Lists page, a Schwab Funds page and so much more. Having an investment account makes it so much easier and offers so many options in finding mutual funds. At first it will take some time getting familiar with the platform but after a while it gets easier. It allows you to find a mutual fund, choose from a preselected pick, look at the fund’s past performance, and view it’s ratings from Morningstar – an investment research company.

One thing to note is that mutual funds carry fees and expenses. These fees carry financial consequences and cut into the growth potential of the fund. Mutual funds are required to disclose their fees up front to their investors. This transparency gives investors information so they can decide whether or not to invest in a fund that may have high expense fees. Make sure you look at the fees for the fund you are looking into before making your decision. Index funds are known for having low fees due to their focus of just mimicking the market they are indexing.

How to purchase Mutual Funds

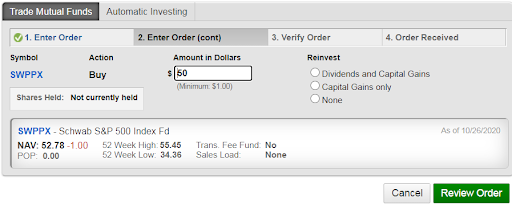

To purchase mutual funds you have identified, select the option to trade a mutual fund in your investment account. Below is an example of the buy form in a Schwab investment account. In this case we entered the mutual fund symbol SWPPX to purchase $50 amount:

Review your order, follow the prompts and you will end up making your purchase. If you have done this, congratulations! It may seem intimidating at first but as you make more trades it will feel more and more natural. Try not to sell too many of your trades as this will have tax consequences and also you want to give your purchase enough time to grow.

Want to learn investing? See my blog about How to start investing